Highest annual shareholder returns in Barrick history – ‘with more to come’

Barrick presentation covered by Mining Weekly's Martin Creamer. Video: Darlene Creamer.

Last quarter production rises to highest level of year.

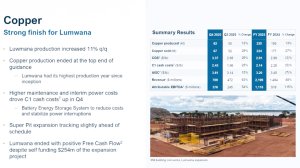

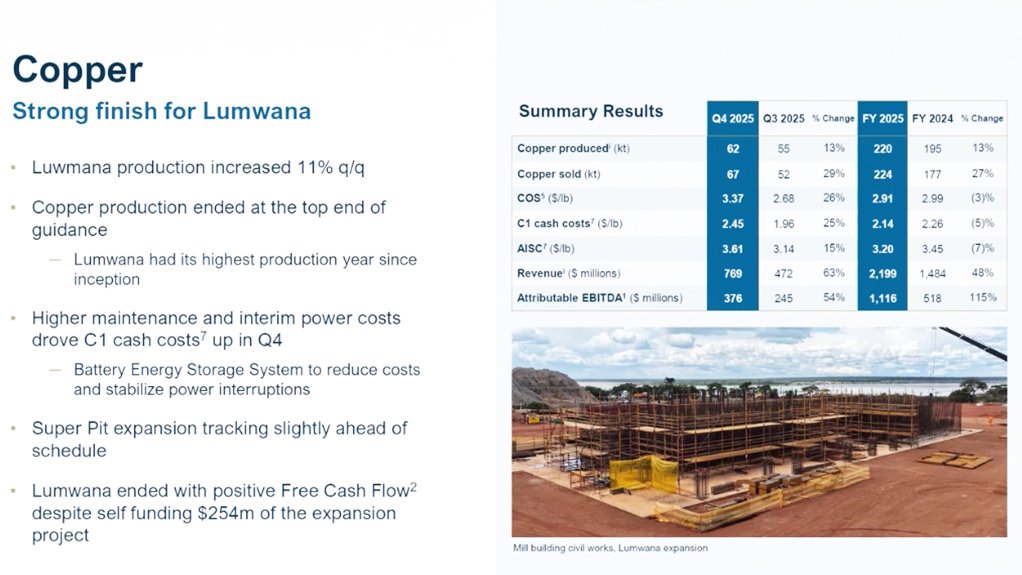

Copper up in Lumwana mine in Africa.

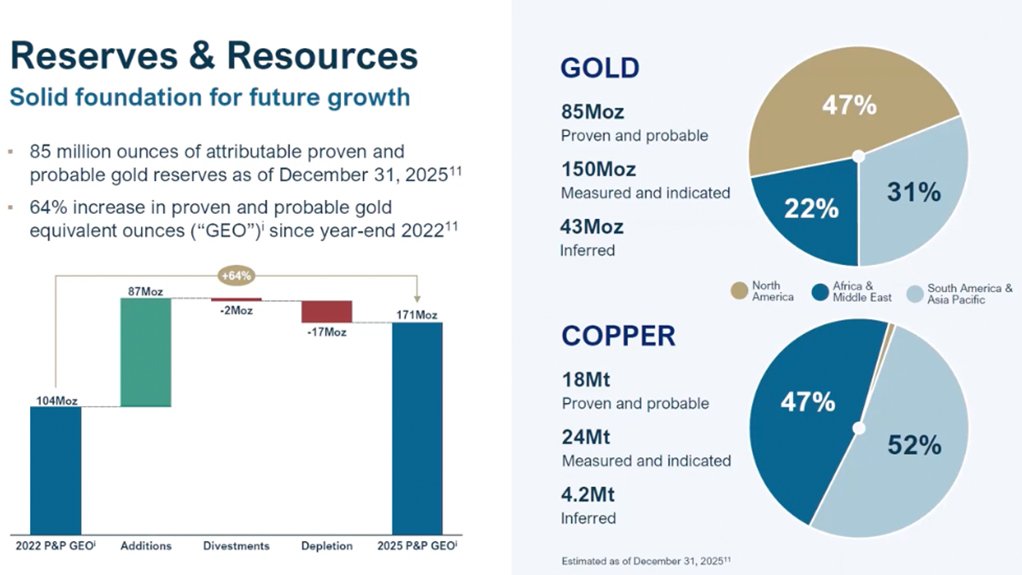

Resources and reserves.

JOHANNESBURG (miningweekly.com) – The balance sheet of New York- and Toronto-listed gold and copper mining company Barrick is in phenomenally good shape, with future capital investment programmes well-funded.

Significant excess cash flow is being generated, with the last quarter of last year chalking up records across almost every financial metric, outgoing Barrick senior executive VP and CFO Graham Shuttleworth noted during his upbeat swansong presentation covered by Mining Weekly. (Also watch attached Creamer Media video.)

The combination of sequential increase in production and record-high gold prices added to an already strong financial foundation and set up the company with considerable flexibility to continue delivering significant cash returns to shareholders.

Infographics displayed a 45% revenue increase, driven by increased production and sales, and a 21% increase in realised gold price.

Major earnings nearly doubled from the prior quarter, and reported was record quarterly cash flow, record free cash flow, record earnings per share and a record cash balance.

Cash of $7.7-billion flowed from operations, $3.9-billion being free cash, which was up 71% and 194% from a year ago – another company record.

These results are super impressive amid Barrick’s 2025 gold sales volume being 13% lower and a key asset not operating for most of the year.

Moreover, attributable capital ended 2025 below the low end of guidance owing to engineering partners coming on board in the refining of spending schedules, particularly at Barrick’s biggest projects – at Reko Diq in Pakistan and Lumwana in Zambia.

Graphs highlighted during the presentation displayed Barrick’s earnings before interest, taxes, depreciation and amortisation (Ebitda) increasing 53% on higher margins as the 21% gold price increase dropped to the bottom line.

Importantly, the attributable Ebitda margin steadily increased through the year, tracking the gold price higher and demonstrating the operating leverage the business provides to the gold price.

“All of this enabled the highest annual shareholder returns in Barrick history, with more to come,” said Shuttleworth.

Barrick ended the year with net cash of $2 billion.

Of the $7.7-billion generation of operating cash flow, $3-billion was invested back into the business with the buyback of $1.5-billion of Barrick stock reducing the company’s share count by 3%.

Third-quarter results saw the base dividend being increased by 25% to $0.125 per quarter and the strong annual results prompted the board to authorise a further 40% increase.

In addition, the board has determined that it will target paying out 50% of attributable free cash flow, incorporating a further discretionary component to reach the target.

On that basis, the board has authorised a fourth-quarter dividend payable in March, which is up 140% on the quarter-three dividend.

This new policy will replace the previous performance dividend policy and given the focus of cash returns to shareholders through increased dividends, with the board having decreed not to renew the annual share buyback programme.

Production increased from last quarter to the highest level of the year, which resulted in an 82% increase in Ebitda versus last year.

The base dividend was increased by another 40% and a new dividend policy adopted.

Cash flow for the quarter was up 96% from last year, and a year of record annual cash returns to shareholders was logged.

Preparation for an initial public offering (IPO) of Barrick’s North American gold assets is moving forward.

“We’re targeting to complete the IPO by late 2026,” new Barrick president and CEO Mark Hill told the presentation.

Operational and financial achievements were, however, overshadowed by four fatalities.

“Our highest priority is that all our people go home safe and healthy at the end of each day, and I'll continue to work with myself and the exco team to achieve and maintain that goal going forward,” Hill promised.

Fourth-quarter gold production was 5% higher than third-quarter production with processing facilities running well.

Full-year gold production of 3.26-million ounces and copper output of 220 000 t were in line with guidance.

Fourth-quarter copper production increased 13% on higher throughput at Lumwana.

In the fourth quarter, the company produced 871 000 oz of gold and 62 000 t of copper, generating revenue of $6-billion. Operating cash flow reached $2.73-billion, while free cash flow totalled $1.62-billion.

For the full year, Barrick reported revenue of $16.96-billion, operating cash flow of $7.69-billion and free cash flow of $3.87-billion, representing increases of 31%, 71% and 194%, respectively, over 2024.

Net earnings for 2025 rose to $4.99-billion, or $2.93 a share, while adjusted net earnings reached $4.14-billion, or $2.42 a share.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation